Friday, August 20, 2010

NUTSHELL BUDDHISM

The following was on the Gummy Blog site and I am putting it here so I do not lose it. Just something to think about. The Gummy site is listed in the links.

BUDDHISM IN A NUTSHELL

Four Noble Truths

1. Suffering exists

2. Suffering arises from attachment to desires

3. Suffering ceases when attachment to desire ceases

4. Freedom from suffering is possible by practicing the Eightfold Path

The Eightfold Path

Right View

Right Thought

Right Speech

Right Action

Right Livelihood

Right Effort

Right Mindfulness

Right Contemplation

Characteristics of Existence

1. Transiency

2. Sorrow

3. Selflessness

Hindrances

1. Sensuous lust

2. Aversion and ill will

3. Sloth and torpor

4. Restlessness and worry

5. Sceptical doubt

Factors of Enlightenment

1. Mindfulness

2. Investigation

3. Energy

4. Rapture

5. Tranquillity

6. Concentration

7. Equanimity

Better than a thousand hollow words, is one word that brings peace.

Do not overrate what you have received, nor envy others. He who envies others does not obtain peace of mind.

Health is the greatest gift, contentment the greatest wealth, faithfulness the best relationship.

Holding on to anger is like grasping a hot coal with the intent of throwing it at someone else; you are the one who gets burned.

I never see what has been done; I only see what remains to be done.

In the sky, there is no distinction of east and west; people create distinctions out of their own minds and then believe them to be true.

Let us rise up and be thankful, for if we didn't learn a lot today, at least we learned a little, and if we didn't learn a little, at least we didn't get sick, and if we got sick, at least we didn't die; so, let us all be thankful.

To be idle is a short road to death and to be diligent is a way of life; foolish people are idle, wise people are diligent.

Virtue is persecuted more by the wicked than it is loved by the good.

You can search throughout the entire universe for someone who is more deserving of your love and affection than you are yourself, and that person is not to be found anywhere. You yourself, as much as anybody in the entire universe deserve your love and affection.

Thank you for your time.

Sunday, August 15, 2010

DARVAS AGAIN CORRECTION

This is not a recommendation to buy or sell any of the stocks discussed on this blog. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Oy. I decided to go look at the code for DARVAS at:

Then I took the time and did the copy and paste into MetaStock. The results for the BOX TOP that I was previously using almost matched, BUT the BOX BOTTOM was way off. OUCH.

You can go to the link and work out and input the code for yourself. Not very hard at all. Right now I am looking at both codes and all those lines and going a bit batty. Trapped in a DARVAS BOX. I think I will go with what is presented in the above link. My thanks to GuppyTraders and to Matthew Ford whom they acknowledge at the site for developing the formulas.

Right now I am going to give this a rest and then go back later to playing around in MetaStock. If you do not go looking and fall down sometimes, then you learn nothing. A chart of AOI.V follows using the guppy provided code for the DARVAS BOX.

Thank you for your time.

DARVAS BOX CODE

This is not a recommendation to buy or sell any of the stocks discussed on this blog. Due diligence is your responsibility. If you need professional investment advice then find a professional.

With so many posts today I must be making up for lost time. Since I have mentioned the DARVAS BOX in the most recent posts I will publish the MetaStock code that I am using. There is a link to a critique of the DARVAS BOX in the link section. You can also google the name and get a lot of hits. If you add MetaStock forum or MetaStock code to your search I am sure you will find information for constructing the box. I know that what I am using was created by someone else. I give my deepest thanks to them but apologize for not knowing exactly where it came from. When I am surfing later I will look for the specific address. Credit and thanks go to the original creator of the following. I have only modified it slightly. Went and found a couple of links for the code.

http://trader.online.pl/MSZ/e-w-Darvas_Box.html

This is the basic one that I modified. Thank you.

http://www.guppytraders.com/gup206.shtml

This one is very detailed and provides information on setting up alerts and all the MetaStock bells and whistles. I will go back and check this one out. Thanks in advance.

http://www.sethi.org/investments/darvas/sbp_java.phtml

This is an online automatic DARVAS BOX generator. Fun to play with and an easy way to check out ideas. No coding or other work involved.

DARVAS BOX TOP MetaStock Code

Topbox:=If(Ref(H,-3)>=Ref(HHV(H,18),-4)

AND

Ref(H,-2) less than Ref(H,-3)

AND

Ref(H,-1)

AND

H less than Ref(H-3),Ref(H-3),PREVIOUS);

Topbox;

The highlighted text should be the math symbol for less than.

DARVAS BOX BOTTOM MetaStock Code

Botbox:=If(Ref(H,-3)>=Ref(HHV(H,18),-4)

AND

Ref(H,-2) less than Ref(H,-3)

AND

Ref(H,-1) less than Ref(H-3)

AND

H less than Ref(H,-3),LLV(L,4),PREVIOUS);

Botbox;

Again the highlighted text should be the math symbol.

DARVAS BOX MIDDLE

For this simply add the above two codes together and divide by 2.

I like the DARVAS BOX visually and the following is what I look for on the charts. If there is a buy signal from another indicator then I will visually check the location of the DARVAS BOX. If it is way above the current price than it is usually best to wait it out. There may be an upmove but possibly only short lived. I like to see the box edges collapse downward towards the price to add a little more confidence in a signal.

A narrower box seems to be more inviting than one that is really wide. When I think about this it is similar to the contraction and expansion of Bollinger Bands. Tight is better.

Another thing that I watch for is the price to drop below the bottom of the box. I then wait it out to see if it can move back into the box. Sometimes this upmove will continue to at least the box top. It is the same with an upmove. If the price can not hold above the box top it maybe a sign of weakness.

Generally though the DARVAS BOX is nice way to spot support and resistance. The most immediate levels as well as past ones can be used.

Anyways, check them out and see what you think. Nothing is a catch all and a combination of a couple of indicators and time frames seems to work the best.

I am starting to babble so I will end this. A couple of charts follow. One just to shows the DARVAS BOX, the other is a stock chart as weird art. Which is which?

Thank you for your time.

Thank you for your time.

COP.TO Example

This is not a recommendation to buy or sell any of the stocks discussed on this blog. Due diligence is your responsibility. If you need professional investment advice then find a professional.

The following is an example of the stuff I have presented in the last couple of entries. The first is a chart of COP.TO. This came up as a possible buy candidate using the KASEAVG indicator as a scan. The criteria was that the current close was above the indicator while the previous close was below it. Out of a universe of about 3,000 there were close to 200 results. Then it was a matter of scrolling through the results to see if anything looked good. Being the penny world many of the charts look more like modern art than price charts. Some very wild and volatile pictures to say the least. Anyways only one really caught my interest to bother watching. COP.TO.

I used the GreenShot annotation tool to add a couple of lines. Although the software is good to use for capture I was not that happy with the annotation. Mostly the ability to add text which is very limited. Oh well. This means that an explanation is here instead of on the chart.

Green arrow at bottom is signal. Upper black arrow is the DARVAS top. White arrow is the DARVAS bottom. Middle black arrow is the KASEAVG.

It is now a matter of seeing how the price performs inside the DARVAS BOX. Interesting that the closing price is right at the middle of the DARVAS BOX. Important lower levels are at the KASEAVG, the DARVAS Bottom and the modified KASE. Will watch to see if these are tested. The upper level that I am watching is the DARVAS Top at .41 as well as the longer recent DARVAS top at .43.

Using the PersonalStockMonitor program I have set upper and lower alerts. That way if something happens it will tell me about it. The upper alert is set at .41, the lower is set at .36. The program has a setting in the alerts that they call sticky. Simply means that a trigger of the alert does not clear the alert. Nice feature. The alerts are also somewhat customizable which is a very nice feature. Will have to wait and see how COP.TO does in the future.

It is nice to have the alert function so that as soon as I look at my watch list I can focus on what alert has gone off and which stock to focus on. Much better than looking over each stock in a watch list to see if some criterion has been met. There is also a note function which seems to be a standard feature in these programs. The following is a screen shot of PersonalStockMonitor with a list of my watch portfolio and then the chart below. You can easily scroll through the charts in your list as well. Good all around, they have my money. Thank you for your time.

Thank you for your time.

Portfolio Software + Screen Capture

This is just a note about a couple of software programs I stumbled across. The first is a basic screen capture. It is free and works pretty good. Not real fancy but gets the job done well.

http://getgreenshot.org/

The other program is a portfolio manager. I still use a modified Excel template provided by Gummy. His link is in the link section. Thank you Gummy. However, I was looking for something that was a little more automatic in execution. After trying a few portfolio managers and not liking them that much I came across the following.

http://www.personalstockmonitor.com/index.html

It is free to try for 30 days, which I am doing now. The cost is 49.95 us and I am sure I will purchase their product. Think I will do that right now. Check out their website if you are interested.

The program is fairly basic and maybe that is why I like it. The charts are also pretty basic as well, but then I have MetaStock if I want the bells and whistles. For easy access and a quick look at what is going on with my portfolio and stocks of interest this fits the bill. Have a look and use the free trial, I think it is a good product.

Thank you for your time.

KASE INDICATOR + SOURCES

This is not a recommendation to buy or sell any of the stocks discussed on this blog. Due diligence is your responsibility. If you need professional investment advice then find a professional.

The following links are for the KASE Dev-Stop indicator. From these I ended up using the first one in a modified manner. The modifications made were in the time frame used, the SD multiplier and a switch from a Stop indicator to an Entry indicator. There is also only one line displayed instead of the six originally used.

http://forum.equis.com/forums/thread/1309.aspx

http://www.mta.org/eweb/docs/Issues/41%20-%201993%20Summer.pdf

http://trader.online.pl/MSZ/e-w-Kase_DevStop.html

Here is the MetaStock code from the first link:

Per1:=Input("max length",10,100,30);

RWH:=(H-Ref(L,-Per1))/(ATR(Per1)*Sqrt(Per1));

RWL:=(Ref(H,-Per1)-L)/(ATR(Per1)*Sqrt(Per1));

Pk:=Mov((RWH-RWL),3,W);

AVTR:=Mov(HHV(H,2) - LLV(L,2),20, S);

SD:=Stdev(HHV(H,2) - LLV(L,2),20);

Val6:=If(Pk>0,HHV(H-AVTR-(4*SD),20),LLV(L+AVTR+(4*SD),20));

Val5:=If(Pk>0,HHV(H-AVTR-(3*SD),20),LLV(L+AVTR+(3*SD),20));

Val4:=If(Pk>0,HHV(H-AVTR-(2*SD),20),LLV(L+AVTR+(2*SD),20));

Val3:=If(Pk>0,HHV(H-AVTR-SD,20),LLV(L+AVTR+SD,20));

Val2:=If(Pk>0,HHV(H-AVTR,20),LLV(L+AVTR,20));

Val1:=If(Pk>0,HHV(H-AVTR+SD,20),LLV(L+AVTR-SD,20));

Val6;Val5;Val4;Val3;Val2;Val1;

Here is the modified code:

RWH:=(H-Ref(L,-18))/(ATR(18)*Sqrt(18));

RWL:=(Ref(H,-18)-L)/(ATR(18)*Sqrt(18));

Pk:=Mov((RWH-RWL),3,W);

AVTR:=Mov(HHV(H,2) - LLV(L,2),18, E);

SD:=Stdev(HHV(H,2) - LLV(L,2),18);

Val6:=If(Pk>0,HHV(H-AVTR-(4*SD),18),LLV(L+AVTR+(4*SD),18));

Val5:=If(Pk>0,HHV(H-AVTR-(3*SD),18),LLV(L+AVTR+(3*SD),18));

Val4:=If(Pk>0,HHV(H-AVTR-(2*SD),18),LLV(L+AVTR+(2*SD),18));

Val3:=If(Pk>0,HHV(H-AVTR-SD,18),LLV(L+AVTR+SD,18));

Val2:=If(Pk>0,HHV(H-AVTR,18),LLV(L+AVTR,18));

{Val1:=If(Pk>0,HHV(H-AVTR+SD,18),LLV(L+AVTR-SD,18));}

Val1:= LLV(L+AVTR-.3*SD,18);

{Val6; Val5; Val4; Val3; Val2;}

Val1;

The following chart displays both the original and modified KASE. The ribbon at the bottom of the chart shows the buy and sell signals generated by crossing the modified KASE.

The other addition is the DARVAS BOX lines, (bottom, middle and top) displayed in the lower panel. I like these and use them as a sort of adapting support and resistance indicator. I may get into more detail in a later post.

For what it is worth, there it is. There has been no rigorous back-testing and all the other checks to verify the validity of using this indicator. For myself, I simply like the way it looks.

Credit goes to Cynthia Kase, Darvas and the people who wrote the codes that I used. I could not have done the modifications without their original work. Thank you.

Thank you for your time.

Saturday, August 14, 2010

STUMPED

I switched to the new settings for this and then got stuffed by them. Image upload in particular.

After composing and then having to delete a couple of times I am stopping for now. Can only push that rock up the hill so many times. Will come back later. Have switched back to the old.

Thank you for your time.

Been Awhile

This is not a recommendation to buy or sell any of the stocks discussed on this blog. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Long past updating this blog. Will have to see whether I get back into the habit of posting regularly.

I am no longer following the U.S. markets on a daily basis. Instead I have moved my efforts to the Canadian markets and the land of penny stocks. I have placed a very small amount of money into play and have broken almost all the rules in doing so. The point was reached of either put up or shut up. Talk is cheap and I decided I had to put up. Alas, I am now holding losing positions but have gained from the experience.

The following chart is where I presently stand Aug 14, 2010. Not a pretty sight.

All of these picks were from surfing the net and finding ideas from other people. Not a bad way to find ideas. Though my mistakes after the initial findings were numerous. The main errors were not paying enough attention to the technicals before the initial entry, then not having the guts to admit an error by using proper money management. The often talked about GREED and FEAR came fully into play.

So, where to now? To paraphrase Darwin: Survival goes to those who adapt.

If avoidance behavior can be viewed as adaption then that is where I stand now. Despite knowing that the above chart is not a pretty sight I am not willing to pull the plug. The FEAR of losing the money dominates but with the full knowledge that it can get worse. When I look over the charts some of them are plain awful, others not so bad. I will tough it out for now.

Part of my avoidance behavior is returning to this blog. Another has been to go indicator hunting. I have also gone searching for easy to use portfolio software along with a couple of other do-dads. The results of this avoidance behavior will be in the next post.

Thank you for your time.

Sunday, February 7, 2010

BBB 07 Maybe Major Change

This is not a recommendation to buy or sell any of the stocks discussed on this blog. Due diligence is your responsibility. If you need professional investment advice then find a professional.

This is just a quick post of a couple of Dow charts. Perhaps it forbodes to a down future, perhaps not. That is for the market alone to decide. Yes the Dow is old and often discarded but it still holds an iconic status that is hard to ignore. Call me old school if you like. Anyways on with the charts that make me think that the whole thing is about to fall apart to the downside.

Sorry if they are kind of messy, I have not done this for awhile. And with the long term daily chart it is okay to wonder where the price is. The big black arrow is way back in June 2008 and then nothing good happened until the red line went back to positive in March 2009. With this same indicator now dropping back to being negative I have to wonder if anything good is in the offing for the next few months.

The next chart is a shorter view of the above. As long as the ribbon indicator at the bottom of the chart stays brown I am not very positive about any upmoves.

The final chart is the weekly Dow. Perhaps there is hope for an upmove since the signal here is still on the positive side. However, a couple of brown spots have shown up on the bottom ribbon which at least suggest caution. If the indicator drops onto the negative side then it may not be a rosy next few months.

The final chart is the weekly Dow. Perhaps there is hope for an upmove since the signal here is still on the positive side. However, a couple of brown spots have shown up on the bottom ribbon which at least suggest caution. If the indicator drops onto the negative side then it may not be a rosy next few months. As always no one can predict the future and only time will reveal the outcome. See what happens and enjoy the show.

As always no one can predict the future and only time will reveal the outcome. See what happens and enjoy the show.

Thank you for your time.

Tuesday, December 29, 2009

LL29 Ending of 09

I took a couple of days off from this and it turned into a couple of weeks. Good habits can be hard to start but easy to break.

My time away gave me a chance to re-think what I am trying to accomplish. When I reviewed the amount of data I had to plow through it was obviously not the proper approach. Too much stuff on a daily basis just adding to the pile. A watch list with over a hundred stocks just does not seem productive.

My current solution, only a couple of weeks old, is to consolidate the signals. Scan for daily signals where the stock has moved into a situation where all of the signals are positive. This list is then checked against the same scan but with a weekly basis. A daily signal confirmed by a weekly signal. So far the results look promising.

When I find the time in the next week or so I will provide the details of what I am now doing. This will provide me with an opportunity to settle the new stuff in my own mind. Writing things down helps. Also, once I am settled in with the new method I will post some of the scan results. For now though it is just time to let things gel.

The old bus crashed in the ditch and I am now picking up the useful parts and rebuilding to continue the journey.

Thank you for your time.

Saturday, December 5, 2009

LL04 Spreadsheet

Friday, December 4, 2009

LL03 Spreadsheet

Wednesday, December 2, 2009

LL02 Spreadsheet

Tuesday, December 1, 2009

LL01 Spreadsheet

Monday, November 30, 2009

KK30 Spreadsheet

Saturday, November 28, 2009

KK27 Spreadsheet

Wednesday, November 25, 2009

KK25 Spreadsheet

Tuesday, November 24, 2009

KK24 Spreadsheet

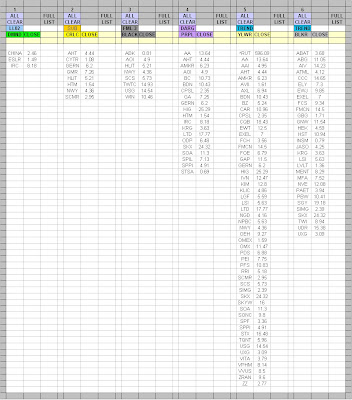

Monday, November 23, 2009

KK23 Spreadsheet

This is not a recommendation to buy or sell any of the stocks discussed on this blog. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Table below. I noticed on the weekend that the settings for a couple of indicators were weekly, not daily. Oh well, fixed now. Long list today. Perhaps a rally into the holiday. Wait and see.

Thank you for your time.

Saturday, November 21, 2009

KK20 Spreadsheet

Thursday, November 19, 2009

KK19 Spreadsheet

Wednesday, November 18, 2009

KK18 Spreadsheet

Tuesday, November 17, 2009

KK17 Spreadsheet

Monday, November 16, 2009

KK16 Spreadsheet

Saturday, November 14, 2009

KK13 Spreadsheet

Thursday, November 12, 2009

KK12 Spreadsheet

Wednesday, November 11, 2009

KK11 Spreadsheet

Tuesday, November 10, 2009

KK10 Spreadsheet

Monday, November 9, 2009

KK09 Spreadsheet

Friday, November 6, 2009

KK06 Spreadsheet

Thursday, November 5, 2009

KK05 Spreadsheet

Wednesday, November 4, 2009

KK04 Spreadsheet

Tuesday, November 3, 2009

KK03 Spreadsheet

Monday, November 2, 2009

KK02 Spreadsheet

This is not a recommendation to buy or sell any of the stocks discussed on this blog. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Table below.

World Series and Monday Night Football. Hard to pay attention to this. There does not seem to be very much that looks pretty for an upmove in the charts. Wait and see. Have an eye to watching two old standards in the next little while. EK and XRX. Will have to pay attention to see if the charts start to look promising.

Thank you for your time.