Hello and welcome to my blog.

The spreadsheet link for EE29 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

End of May and will have to see if they go away. Signals still about even for both sides. Matches the sideways market over the last month.

Thank you for your time.

http://spreadsheets.google.com/pub?key=re3GhT5bUAik3pt9NXIUuAA&single=true&gid=0&output=html

Friday, May 29, 2009

Thursday, May 28, 2009

EE28 Spreadsheet Link

Hello and welcome to my blog.

The spreadsheet link for EE28 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Up, down, up, down, up, down, up,......Oy.

Up signals return. Too tired to think.

Thank you for your time.

http://spreadsheets.google.com/pub?key=ruqvWNlk4nUfTQ2c01WBz8w&single=true&gid=0&output=html

The spreadsheet link for EE28 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Up, down, up, down, up, down, up,......Oy.

Up signals return. Too tired to think.

Thank you for your time.

http://spreadsheets.google.com/pub?key=ruqvWNlk4nUfTQ2c01WBz8w&single=true&gid=0&output=html

Wednesday, May 27, 2009

EE27 Spreadsheet Link

Hello and welcome to my blog.

The spreadsheet link for EE27 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

The number of spreadsheet entries returned to a much more reasonable level today. Still more up entries than down entries though.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rmlunD5kelCtrvejDsi5UTQ&single=true&gid=0&output=html

The spreadsheet link for EE27 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

The number of spreadsheet entries returned to a much more reasonable level today. Still more up entries than down entries though.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rmlunD5kelCtrvejDsi5UTQ&single=true&gid=0&output=html

Tuesday, May 26, 2009

EE26 Spreadsheet Link

Hello and welcome to my blog.

The spreadsheet link for EE26 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Huge number of early up signals. Almost at the point of getting out of hand. A large number of green up alerts and only a small number of orange down alerts.

Reaching the point of having to put together a mind map or a flow chart of the signals to clear up what I am looking at. Counter signals sometimes add to the confusion. Will look into doing this in the next few days.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rHva4ISbzHgGdHhYaAZ6_Sw&single=true&gid=0&output=html

The spreadsheet link for EE26 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Huge number of early up signals. Almost at the point of getting out of hand. A large number of green up alerts and only a small number of orange down alerts.

Reaching the point of having to put together a mind map or a flow chart of the signals to clear up what I am looking at. Counter signals sometimes add to the confusion. Will look into doing this in the next few days.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rHva4ISbzHgGdHhYaAZ6_Sw&single=true&gid=0&output=html

Friday, May 22, 2009

EE22 Spreadsheet Link

Hello and welcome to my blog.

The spreadsheet link for EE22 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Thank you for your time.

http://spreadsheets.google.com/pub?key=raOt4UOSd5gGesOcku2sBNQ&single=true&gid=0&output=html

The spreadsheet link for EE22 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Thank you for your time.

http://spreadsheets.google.com/pub?key=raOt4UOSd5gGesOcku2sBNQ&single=true&gid=0&output=html

Thursday, May 21, 2009

EE21 Spreadsheet Link

Hello and welcome to my blog.

The spreadsheet link for EE21 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

About twice as many orange down alerts than green up alerts.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rwAUxtvMsi6bN-xc-NkZT5Q

The spreadsheet link for EE21 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

About twice as many orange down alerts than green up alerts.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rwAUxtvMsi6bN-xc-NkZT5Q

Wednesday, May 20, 2009

EE20 Spreadsheet Link

Hello and welcome to my blog.

The spreadsheet link for EE20 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Green up alerts and orange down alerts may as well be equal in number. Maybe more evidence of a market deciding on which direction to go. There are far more up early signals than down early ones but the down watch list is fairly long compared with up watch list. Oy, spin the wheel and guess where the ball will land. Up, down, sideways....

Thank you for your time.

http://spreadsheets.google.com/pub?key=rWnZwpGPeOCAbki9InskgXQ

The spreadsheet link for EE20 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Green up alerts and orange down alerts may as well be equal in number. Maybe more evidence of a market deciding on which direction to go. There are far more up early signals than down early ones but the down watch list is fairly long compared with up watch list. Oy, spin the wheel and guess where the ball will land. Up, down, sideways....

Thank you for your time.

http://spreadsheets.google.com/pub?key=rWnZwpGPeOCAbki9InskgXQ

Tuesday, May 19, 2009

EE19 Spreadsheet Link

Hello and welcome to my blog.

The spreadsheet link for EE19 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Perhaps the early signal is getting a bit out of hand. Three columns of 'up early' signals. Maybe too much to keep track of. Will have to see if this is kept in the future. The crayons are fun but can be messy and distracting.

More familiar is that there are fair number of green up alerts versus the orange down alerts.

Up, down, all around. This is maybe an indication of a churning trying to decide market. Certainly the market is up well from the March lows but it is still a long way down from last autumn. When I get the time I will take a look at the weekly charts to try and get a sense of the lay of the land. Forest not trees.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rAzYmqBdHuBzhZNkjH7BA1g

The spreadsheet link for EE19 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Perhaps the early signal is getting a bit out of hand. Three columns of 'up early' signals. Maybe too much to keep track of. Will have to see if this is kept in the future. The crayons are fun but can be messy and distracting.

More familiar is that there are fair number of green up alerts versus the orange down alerts.

Up, down, all around. This is maybe an indication of a churning trying to decide market. Certainly the market is up well from the March lows but it is still a long way down from last autumn. When I get the time I will take a look at the weekly charts to try and get a sense of the lay of the land. Forest not trees.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rAzYmqBdHuBzhZNkjH7BA1g

Monday, May 18, 2009

EE18 Spreadsheet Link

Hello and welcome to my blog.

The spreadsheet link for EE18 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Despite the Dow heading up today there are still a fair number of orange down alerts versus only a few green up alerts. The problem with all the alerts is the sheer number that come along. There are two columns of 'up early' signals, just wiggling and whipsawing or showing what will transpire in the future. Right now, as in many other times, do not know. Still trying to figure out if it is worthwhile to post the 'early' signal or not.

Seems to be a crossroads period right now. Move down and test support at the breakout levels and then move even higher or break through support and head lower. The third option being a sideways churn to keep everyone guessing. Have to see what happens.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rRs3wdwRKn2O3UBW_qbMQ2w

The spreadsheet link for EE18 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Despite the Dow heading up today there are still a fair number of orange down alerts versus only a few green up alerts. The problem with all the alerts is the sheer number that come along. There are two columns of 'up early' signals, just wiggling and whipsawing or showing what will transpire in the future. Right now, as in many other times, do not know. Still trying to figure out if it is worthwhile to post the 'early' signal or not.

Seems to be a crossroads period right now. Move down and test support at the breakout levels and then move even higher or break through support and head lower. The third option being a sideways churn to keep everyone guessing. Have to see what happens.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rRs3wdwRKn2O3UBW_qbMQ2w

Sunday, May 17, 2009

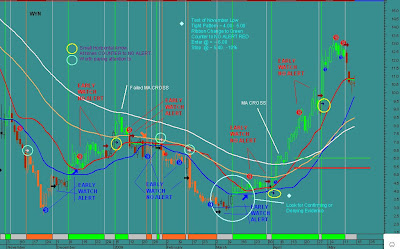

EE17 Chart Example WYN

Hello and welcome to my blog.

The following chart is WYN. This is not a recommendation to buy or sell this stock. Due diligence is your responsibility. If you need professional investment advice then find a professional.

I can not seem to put the crayons away so here is another chart example.

These examples are very much cherry picking to hopefully provide clarity to the signals presented in the spreadsheets. I have seen this sort of pattern appear in many different charts so it becomes the pattern to look for. EARLY...WATCH...ALERT...then confirming or denying evidence. As I scroll through my list of charts I quickly move past the ones that do not demonstrate what I am looking for. At times the list of what to watch becomes overwhelming. Like looking for one of many needles in a haystack and not even being sure the one found is the right one. Gheez. No one said it was going to be easy.

Thank you for your time.

The following chart is WYN. This is not a recommendation to buy or sell this stock. Due diligence is your responsibility. If you need professional investment advice then find a professional.

I can not seem to put the crayons away so here is another chart example.

These examples are very much cherry picking to hopefully provide clarity to the signals presented in the spreadsheets. I have seen this sort of pattern appear in many different charts so it becomes the pattern to look for. EARLY...WATCH...ALERT...then confirming or denying evidence. As I scroll through my list of charts I quickly move past the ones that do not demonstrate what I am looking for. At times the list of what to watch becomes overwhelming. Like looking for one of many needles in a haystack and not even being sure the one found is the right one. Gheez. No one said it was going to be easy.

Thank you for your time.

Chart created with MetaStock.

Saturday, May 16, 2009

EE16 Chart Example AES

Hello and welcome to my blog.

The following chart is AES. This is not a recommendation to buy or sell this stock. Due diligence is your responsibility. If you need professional investment advice then find a professional.

The box of crayons came out once again and the following chart of AES is the result. The hope is to clarify the technical signals I use. EARLY...WATCH...ALERT. Then other evidence to either confirm or deny the action to be taken. With AES a basic resistance level at 7.00 was broken to confirm an entry. Of course looking back is always easy. "If my aunt had balls."

I hope this example clarifies instead of confuses.

Thank you for your time.

The following chart is AES. This is not a recommendation to buy or sell this stock. Due diligence is your responsibility. If you need professional investment advice then find a professional.

The box of crayons came out once again and the following chart of AES is the result. The hope is to clarify the technical signals I use. EARLY...WATCH...ALERT. Then other evidence to either confirm or deny the action to be taken. With AES a basic resistance level at 7.00 was broken to confirm an entry. Of course looking back is always easy. "If my aunt had balls."

I hope this example clarifies instead of confuses.

Thank you for your time.

Chart created with MetaStock.

Friday, May 15, 2009

EE15 Chart Example RFMD

Hello and welcome to my blog.

The following chart is RFMD. This is not a recommendation to buy or sell this stock. Due diligence is your responsibility. If you need professional investment advice then find a professional.

The box of crayons came out and the following chart is the result. The chart is an example of the signal sequence of EARLY...WATCH...ALERT that worked fairly well. Of course there are tons of times when this has not been the case. I hope the chart is relatively self explanatory.

Currently RFMD is signalling a down decision time meaning that it would make sense to pay attention to any confirming evidence that a down move is in the offing. Only time will tell and will have to wait to see what happens.

Thank you for your time.

The following chart is RFMD. This is not a recommendation to buy or sell this stock. Due diligence is your responsibility. If you need professional investment advice then find a professional.

The box of crayons came out and the following chart is the result. The chart is an example of the signal sequence of EARLY...WATCH...ALERT that worked fairly well. Of course there are tons of times when this has not been the case. I hope the chart is relatively self explanatory.

Currently RFMD is signalling a down decision time meaning that it would make sense to pay attention to any confirming evidence that a down move is in the offing. Only time will tell and will have to wait to see what happens.

Thank you for your time.

Chart created with MetaStock.

EE15 Spreadsheet Link

Hello and welcome to my blog.

The spreadsheet link for EE15 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Again a small change to the spreadsheet with a couple of more columns added. This is a work in progress so I will have to see whether these stay or not. The new columns are up or down signals that are extremely early and subject to greater whipsaw than the other ones used.

The intention of this whole exercise is to develop a lead-in to an entry point. The ideal sequence being...earliest signal...watch signal...alert signal. As the sequence develops there should be enough evidence to confirm of deny a hard entry.

Today there are no up watch signals and no green up alert signals. Plenty of down signals though. The watch down signals are actually less than the orange down alert signals. Will have to see if the downward bias picks up steam.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rdTQyp74DajAiIMa8YMNHhA

Thursday, May 14, 2009

EE14 Spreadsheet Link

Hello and welcome to my blog.

The spreadsheet link for EE14 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

A very long list of orange down alerts and only three green up alerts. My guess is that the large number of orange down alerts can be traced back to the large number of 'watch down' signals over the last few days.

Like the last few days the number of 'watch down' signals is large, two columns worth, and only two 'watch up' signals. Whether these develop into future orange down alerts is yet to be seen.

Time permitting I will try and provide a couple of more chart examples over the next couple of days. Both good and bad ones.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rncrZe3DQTeJNTCrNCYa6yQ

The spreadsheet link for EE14 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

A very long list of orange down alerts and only three green up alerts. My guess is that the large number of orange down alerts can be traced back to the large number of 'watch down' signals over the last few days.

Like the last few days the number of 'watch down' signals is large, two columns worth, and only two 'watch up' signals. Whether these develop into future orange down alerts is yet to be seen.

Time permitting I will try and provide a couple of more chart examples over the next couple of days. Both good and bad ones.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rncrZe3DQTeJNTCrNCYa6yQ

Wednesday, May 13, 2009

EE13 Spreadsheet Link

Hello and welcome to my blog.

The spreadsheet link for EE13 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Only one green up alert and a lot of orange down alerts. Like yesterday there are two columns of 'down watch' signals. Today there are no 'up watch' signals. Will have to see if this dominance of 'down watch' signals develops into a dominance of orange down alerts. Only the market knows what the future holds.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rg132Z7p8M2iJ5qn6ymf9zw

The spreadsheet link for EE13 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Only one green up alert and a lot of orange down alerts. Like yesterday there are two columns of 'down watch' signals. Today there are no 'up watch' signals. Will have to see if this dominance of 'down watch' signals develops into a dominance of orange down alerts. Only the market knows what the future holds.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rg132Z7p8M2iJ5qn6ymf9zw

Tuesday, May 12, 2009

EE12 Chart Signal Example QLGC

Hello and welcome to my blog.

The following chart is QLGC. This is not a recommendation to buy or sell this stock. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Just a quick chart example of the new 'watch' signal being used along with the 'alert' signal.

The 'watch' is just that, watch to see what happens. The ideal is for this to lead into the 'alert' signal. Ha Ha Ha, lots of examples of when it does not work, please remember this is just an example of when it worked.

If not too fuzzy to see there is a 'watch' down arrow at the end of March which did not develop into an 'alert'. After some sideways movement the price continued the initial up move.

At present the recent 'down watch' has developed into a 'down alert'. Will have to wait and see what happens in the next couple of weeks.

Of course this is not a magic bullet, just a way to view the market. What I do enjoy is that once the 'watch' signal occurs there is usually some time to see how the price action develops as it moves towards a possible 'alert' signal. During this time it is possible to apply other criteria to either confirm or deny the possible future signal. Call it lead in time to a potential move.

Enough for now. Chart created with MetaStock.

Thank you for your time.

The following chart is QLGC. This is not a recommendation to buy or sell this stock. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Just a quick chart example of the new 'watch' signal being used along with the 'alert' signal.

The 'watch' is just that, watch to see what happens. The ideal is for this to lead into the 'alert' signal. Ha Ha Ha, lots of examples of when it does not work, please remember this is just an example of when it worked.

If not too fuzzy to see there is a 'watch' down arrow at the end of March which did not develop into an 'alert'. After some sideways movement the price continued the initial up move.

At present the recent 'down watch' has developed into a 'down alert'. Will have to wait and see what happens in the next couple of weeks.

Of course this is not a magic bullet, just a way to view the market. What I do enjoy is that once the 'watch' signal occurs there is usually some time to see how the price action develops as it moves towards a possible 'alert' signal. During this time it is possible to apply other criteria to either confirm or deny the possible future signal. Call it lead in time to a potential move.

Enough for now. Chart created with MetaStock.

Thank you for your time.

EE12 Spreadsheet Link

Hello and welcome to my blog.

The spreadsheet link for EE12 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

As mentioned yesterday the number of 'watch' signals tends to be more than the 'alert' signals. Today the number of 'watch' stocks are split into two columns because of this.

Right now there are a lot of both orange down alerts and watch for down signals. Whether this means that the market is headed for a down move can only be answered by the market itself. My guess is that a down move is in the offing. As always have to see what happens.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rAguUhMb31rcn_KVYPUqGpg

The spreadsheet link for EE12 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

As mentioned yesterday the number of 'watch' signals tends to be more than the 'alert' signals. Today the number of 'watch' stocks are split into two columns because of this.

Right now there are a lot of both orange down alerts and watch for down signals. Whether this means that the market is headed for a down move can only be answered by the market itself. My guess is that a down move is in the offing. As always have to see what happens.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rAguUhMb31rcn_KVYPUqGpg

Monday, May 11, 2009

EE11 Spreadsheet Link CHANGE

Hello and welcome to my blog.

The spreadsheet link for EE11 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

The spreadsheet has changed a little bit from the previous ones. As well as the green up alerts and orange down alerts, there are two other columns called 'watch'. As the name implies these are watch only stocks and not full alerts. There are a greater number of stocks generated by 'watch' because it is a faster signal. The number of false signals are also greater, remember it is only a 'watch' signal and not a fuller pay greater attention 'alert'. No prices are included with this new version and this may change in the future as I get more comfortable with the mechanics of creating the lists.

I am still working out the details of how to present the data and how I can keep it all in order. I will have to see how it all comes together. The underlying intention is to keep a watch on the 'watch' signals and whether the stock has the ability to develop into a full on 'alert' signal. Perhaps I can work something out in excel or simply print the daily alerts and keep this as a play book to refer to.

The other option I have is to simply scroll through the list of stocks and look for the signals manually. Takes a bit of time but keeps it all up front on a daily basis.

Once I get a little more time I will post a couple of chart examples of the 'watch' signal and how it can develop into an 'alert' signal. As well I will post a couple of charts of when it does not develop into an 'alert' signal. None of this is magic or a silver bullet, just some guy trying to figure it out and beat the odds. Off to scroll through the charts.

Thank you for your time.

http://spreadsheets.google.com/pub?key=r7v8HXsFvhiYs44pWvoo_nw

The spreadsheet link for EE11 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

The spreadsheet has changed a little bit from the previous ones. As well as the green up alerts and orange down alerts, there are two other columns called 'watch'. As the name implies these are watch only stocks and not full alerts. There are a greater number of stocks generated by 'watch' because it is a faster signal. The number of false signals are also greater, remember it is only a 'watch' signal and not a fuller pay greater attention 'alert'. No prices are included with this new version and this may change in the future as I get more comfortable with the mechanics of creating the lists.

I am still working out the details of how to present the data and how I can keep it all in order. I will have to see how it all comes together. The underlying intention is to keep a watch on the 'watch' signals and whether the stock has the ability to develop into a full on 'alert' signal. Perhaps I can work something out in excel or simply print the daily alerts and keep this as a play book to refer to.

The other option I have is to simply scroll through the list of stocks and look for the signals manually. Takes a bit of time but keeps it all up front on a daily basis.

Once I get a little more time I will post a couple of chart examples of the 'watch' signal and how it can develop into an 'alert' signal. As well I will post a couple of charts of when it does not develop into an 'alert' signal. None of this is magic or a silver bullet, just some guy trying to figure it out and beat the odds. Off to scroll through the charts.

Thank you for your time.

http://spreadsheets.google.com/pub?key=r7v8HXsFvhiYs44pWvoo_nw

Friday, May 8, 2009

EE08 Spreadsheet Link

Hello and welcome to my blog.

The spreadsheet link for EE08 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Only a few green up alerts and a few orange down alerts.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rVyVvSzyORu8qc1pMmCO3Ug

The spreadsheet link for EE08 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Only a few green up alerts and a few orange down alerts.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rVyVvSzyORu8qc1pMmCO3Ug

Thursday, May 7, 2009

EE07 Spreadsheet Link

Hello and welcome to my blog.

The spreadsheet link for EE07 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Orange down alerts make a return. A few green up alerts present.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rXHLDmexgpwkOTHzlRgks8g

The spreadsheet link for EE07 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Orange down alerts make a return. A few green up alerts present.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rXHLDmexgpwkOTHzlRgks8g

Wednesday, May 6, 2009

EE06 Spreadsheet Link

Hello and welcome to my blog.

The spreadsheet link for EE06 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

The green up alerts continue to show up. Only four orange down alerts.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rfkUcVmSrgNLJIyzF-oxJng

The spreadsheet link for EE06 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

The green up alerts continue to show up. Only four orange down alerts.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rfkUcVmSrgNLJIyzF-oxJng

Tuesday, May 5, 2009

EE05 Spreadsheet Link

Hello and welcome to my blog.

The spreadsheet link for EE05 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Green up alerts continue to appear. Only two orange down alerts.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rapOEya9zLp0TqqNL4dYMPg

The spreadsheet link for EE05 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Green up alerts continue to appear. Only two orange down alerts.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rapOEya9zLp0TqqNL4dYMPg

Monday, May 4, 2009

EE04 Spreadsheet Link

Hello and welcome to my blog.

The spreadsheet link for EE04 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

A sea of green up alerts. Only four orange down alerts. Party on.

Dow clearing 8100 with some authority. Have to look for the next place for a possible stall out.

Threes would say...8400, 8700, 9000, etc. On a rough measure, without peeking, low was about 6600, up to 8100 would be 1500 points. 8100 added to 1500 gives...9600. No one knows if the Dow has the legs to make it that far, except the Dow.

The old saying is "Sell em in May and go away." Old sayings stick around for a reason and will have to wait to see if this occurs this year. Perhaps the rally is so the "They" can sell out to the "them".

Played around a little more with MetaStock and just ended up with pretty lines and arrows. Not much good. When it is all said and done it comes down to Price, Time, and Volume. I have to get back to that thought mode since anything else is just fartin around and avoiding the reality of trading. Aiming to return to the basics and execute the plan. Da da da.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rt5w61nqkUT8ZqK3ASFecnw

The spreadsheet link for EE04 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

A sea of green up alerts. Only four orange down alerts. Party on.

Dow clearing 8100 with some authority. Have to look for the next place for a possible stall out.

Threes would say...8400, 8700, 9000, etc. On a rough measure, without peeking, low was about 6600, up to 8100 would be 1500 points. 8100 added to 1500 gives...9600. No one knows if the Dow has the legs to make it that far, except the Dow.

The old saying is "Sell em in May and go away." Old sayings stick around for a reason and will have to wait to see if this occurs this year. Perhaps the rally is so the "They" can sell out to the "them".

Played around a little more with MetaStock and just ended up with pretty lines and arrows. Not much good. When it is all said and done it comes down to Price, Time, and Volume. I have to get back to that thought mode since anything else is just fartin around and avoiding the reality of trading. Aiming to return to the basics and execute the plan. Da da da.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rt5w61nqkUT8ZqK3ASFecnw

Friday, May 1, 2009

EE01 Spreadsheet Link

Hello and welcome to my blog.

The spreadsheet link for EE01 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Green up alerts continue to show up, only a few orange down alerts.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rfhZ6n4Apfe_kWEfaizUwxQ

The spreadsheet link for EE01 is below. This is not a recommendation to buy or sell any of the stocks listed. Due diligence is your responsibility. If you need professional investment advice then find a professional.

Green up alerts continue to show up, only a few orange down alerts.

Thank you for your time.

http://spreadsheets.google.com/pub?key=rfhZ6n4Apfe_kWEfaizUwxQ

Subscribe to:

Posts (Atom)