Hello and welcome to my blog.

This is not a recommendation to buy or sell any of the stocks discussed on this blog. Due diligence is your responsibility. If you need professional investment advice then find a professional.

I thought of the title 'Digging Holes' for this entry but figured that climbing and changing was more positive.

A few days ago in the library I noticed the book "Sell and Sell Short" by Elder. From his book I picked up a few ideas that I figured I could incorporate. The first was his calendar idea and using Outlook to track trades. Not exactly the format I wanted but the thought had been planted. The final result is the calendar format I presented a couple of days ago. Something I am happy with.

The other idea I picked up was the 2% money (risk) management concept. Although I already had something similar in place I got busy and formalized the concept. The idea became reality as another page in a spreadsheet. Very easy to create and grounded is better than floating. Now it is easy to just open the page and find the reference.

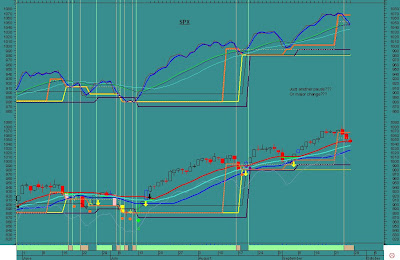

The final idea I picked up was his use of the slope of the moving averages. An idea I had toyed with before but never really pursued. Well, the last few days I have been looking into using the moving average slope as an indicator. Time to get out the crayons and throw more parts at the bus. So far I am pleased with my results. Right now though I am sitting with new stuff sloshing around in my brain waiting for the jello to gel.

Since I use 4 varieties of a moving average I took the slope of each of these and then took the average of this result. This seemed good as a trend indicator when it crossed from below to above 0. However it is a few days slower than the slope of the 18 day moving average. Given this lag I ended up using the faster 18 day moving average. The intention is to use the crossing of 0 as another entry signal and the slower one for confirmation. The confirming (lagged) signal also works well with the other trend signal I use. So the end result is the faster indicator has been added to the signals I am already using and the look so far seems promising. The major change is that it eliminates more of the early (false) signals which were showing up before.

With just the preliminary parts in place and only a cursory look at the charts I think it is worth keeping the slope indicator in place. The slightly larger time lag is compensated by the increase in confidence.

The next few weeks of real time will be the final decider of whether these added indicators are kept or not. Will just have to wait and see.

The chart of ALU follows. This has been used as an example in earlier posts. The gold price bars are when the slope indicator is above 0. These actually show up prior to the full ALL CLEAR signal during July. The jello is still hardening. The green line in the top pane is a histogram line of the slope indicator, the black histogram bar in the same pane is the moving average trend confirmation indicator.

Thank you Doctor Elder for the seeds.

Thank you for your time.